$1.8bn

AuM

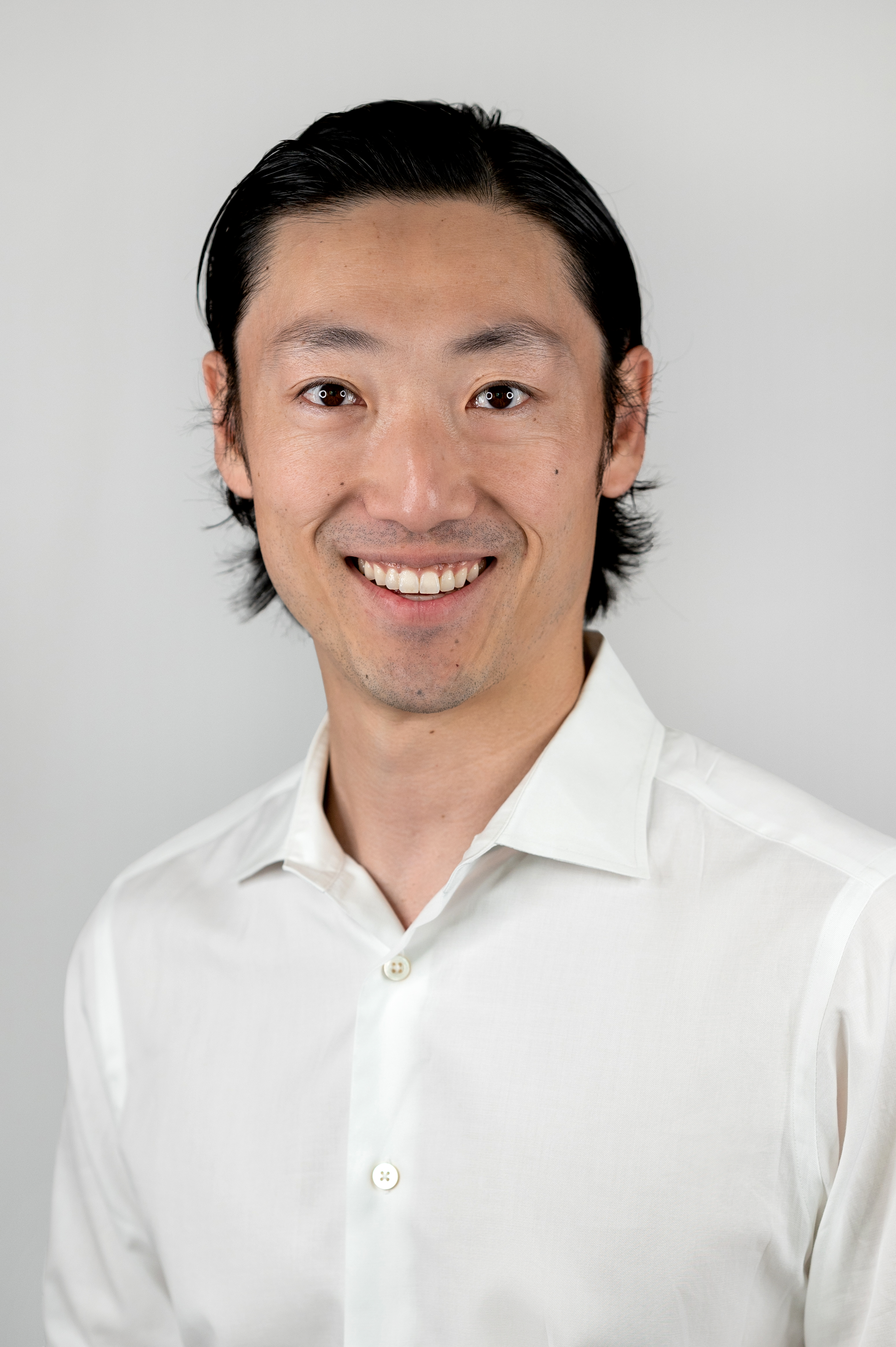

25+

investments

90%

primary founder/owners transactions

Investment Thesis

Quilvest Capital Partners’ Buyout team partners with entrepreneurs and founders of small to mid-sized companies to support the next phase of their growth, working together to achieve ambitious goals. We back companies with a track record of profitable growth, focusing deeply on targeted verticals within the Business Services (Software & Telecom, Outsourced Services) and Consumer (Education, Next Gen Consumer, Multi Unit) sectors, driven by strong underlying macro-trends.

Lower Middle Market Buyout

Our investment strategy has remained the same over the past 15 years: we take majority or influential minority stakes in the lower middle market. We invest in North America and Western Europe, mainly France, UK, Switzerland and the Benelux.

Situation

We focus on primary founder/ owner or primary-like situations where we believe there is more alpha potential. We aim to partner with managers who behave as buyers, typically months ahead, or outside of processes. This helps us build a deep understanding of companies and create strong relationships with managers.

Tailored Value Creation Support

We work closely with managers to structure and institutionalize their companies, driving transformational change by implementing a tailored value creation plan. This strategy includes internationalization, leveraging the global Quilvest platform, expanding human resources, supporting add-on acquisitions, enhancing digitalization, and advancing ESG transformation.

Team Strengthening

Board Reinforcement

Footprint Expansion

External Growth

Digital Transformation

Sustainable Transformation

Our Paris-based professionals

Lisa joined Quilvest Capital Partners in 2022. She is a Senior Analyst of the Buyout team and is based in Paris.

Before joining Quilvest in 2022, Lisa worked in a Consulting Strategy firm named Rise Conseil in Paris as well as in the Finance Department at Club Med Australia.

Lisa graduated from EMLyon Business School, where she studied Finance and Strategy.

Deals:

Minafin | Les Secrets de Loly | RCA | Lunettes Pour Tous

Clara joined Quilvest Capital Partners in November 2024 as a Senior Analyst in the Buyout team, based in Paris.

Prior to joining Quilvest, Clara spent two years in M&A at Perella Weinberg Partners in London, focusing on French coverage.

She also completed an M&A internship at Bank of America in Paris and another with Antin Infrastructure Partners in London.

Clara graduated from ESSEC Business School with a Master in Management.

Deals:

Cabaia | Ermitage

Hichem joined Quilvest Capital Partners in 2015. He is a Partner of the Buyout team and is based in Paris.

Before joining Quilvest Capital Partners, Hichem spent four years in the M&A department of UBS in Paris.

Hichem is a graduate of Ecole Centrale Paris with a major in Financial Mathematics.

Deals:

Sogetrel | Eudonet | EDH | Solem | Les Secrets de Loly | Cabaia | Ermitage | Lunettes Pour Tous

Guillaume joined Quilvest Capital Partners in 2010. He is a Managing Director of the Buyout team and is based in Paris.

Before joining Quilvest Capital Partners, Guillaume spent 3 years in the Mergers and Acquisitions department of Rothschild in Paris.

Prior to that experience, Guillaume also worked at Schneider Electric.

Guillaume is a graduate of HEC (Ecole des Hautes Etudes Commerciales) Paris with a major in Finance.

Deals:

Acrotec | Eudonet | BT Blue | RCA | Ermitage

Loeïz joined Quilvest Capital Partners in 2006. He is a Partner of the Buyout team and is based in Paris.

Before joining Quilvest Quilvest Capital Partners, Loeïz spent 2 years with the Boston Consulting Group in Paris and Barcelona.

Loeïz is a graduate of HEC (Ecole des Hautes Etudes Commerciales) Paris and was awarded an MBA from Harvard Business School. He also holds a masters in French corporate law.

Deals:

Tortilla | Sogetrel | EDH | BT Blue | Minafin | Fuller’s Food | RCA | Acuiti Labs

Anthony joined Quilvest Capital Partners in 2025. He is a Vice President in the Buyout team and is based in Paris.

Anthony has extensive experience in growth equity and private equity, having worked on several investment opportunities across Europe, in particular in the consumer sector.

Prior to joining Quilvest Capital Partners, Anthony was a Principal at Label Capital, an European growth equity fund, where he led investments in IVB, Curex, and Ex Nihilo. Before that, he worked at L Catterton, where he was involved in the investment in A.P.C. and oversaw the fund’s stakes in JOTT and Goiko. Anthony began his career at the Boston Consulting Group (BCG), first in Paris and later in New York, where he was a core member of the Consumer and Private Equity practices.

Anthony holds degrees from Sciences Po Paris and London Business School.

Deals: Ermitage | Blue

Thomas joined Quilvest Capital Partners in 2005. He is a Partner, heads the Buyout team and is based in Paris.

Thomas has more than 20 years of experience in Private Equity and has worked on several LBOs.

Prior to joining Quilvest Capital Partners, Thomas started his career in the Mergers and Acquisitions department of Lazard Frères, first in New York and then in London.

Thomas is a graduate of ESCP (Ecole Supérieure de Commerce de Paris) and holds a Master in Industrial Organization from La Sorbonne, awarded with honours.

Deals:

Acrotec | Sogetrel | Eudonet | EDH | Phaidon | BT Blue | Minafin | Solem | Les Secrets de Loly | Cabaia | Ermitage | Lunettes Pour Tous

Guy Zarzavatdjian

Chairman of the Buyout European Investment CommitteeGuy joined Quilvest Capital Partners in 2014 as a CEO. In 2018, Guy transitioned out of this previous role to become the Chairman of the European Investment Committee of the Buyout team and is based in Paris.

Guy has over 30 years of private equity experience across Europe, the USA, and Emerging Markets. He has sourced and completed more than 50 private equity investments during his career in private equity.

Prior to joining Quilvest, Guy was a member of 3i Group Management Committee, Managing Partner of Growth equity investments, Managing Partner of Developing Markets, Chairman and Managing Partner of France and Managing Director of Benelux.

Before joining 3i Group in 1987, Guy worked at Eli Lilly and for a family-owned business.

Our New York-based professionals

Kevin Cox

AssociateKevin joined Quilvest Capital Partners in 2024. He is an Associate within the Buyout team and is based in New York.

He works on the closing and due diligence of direct buyout investments.

Prior to joining Quilvest Capital Partners, Kevin was an Investment Banking Analyst in the Healthcare M&A advisory group at Rothschild & Co.

Kevin holds a BSBA in Finance from the McDonough School of Business at Georgetown University.

Chad joined Quilvest Capital Partners in 2021. He is a Senior Associate of the Buyout team and is based in New York.

Prior to joining Quilvest in 2021, Chad was an investment banking analyst at Jefferies in the Media, Communications and Information Services Group.

Before joining Jefferies, Chad was an investment banking analyst in the Technology Group at KeyBanc Capital Markets.

Chad graduated from the University of Michigan’s Ross School of Business with a Bachelor of Business Administration.

Deals:

Metro | Creative | Exer | Tri-Imaging

Tej joined Quilvest Capital Partners in 2025. He is an Associate within the Buyout team and is based in New York.

Prior to joining Quilvest, Tej was a Private Equity Associate at H.I.G. Capital in the Middle Market Fund. Tej started his career as an Investment Banking Analyst at Mizuho in the Financial Sponsors Group.

Tej graduated from the Wharton School at the University of Pennsylvania with a BS in Economics.

Abigail joined Quilvest Capital Partners in 2025. She is an Executive Assistant within the Buyout team, based in New York.

Prior to joining Quilvest, she worked as an Executive Assistant at the Zittman Family Office, where she provided high-level executive support, managed complex travel arrangements, and coordinated financial activities.

She also worked as a Travel Advisor at AZA Luxury Travel, where she applied her expertise in curating personalized travel experiences.

Omar joined Quilvest Capital Partners in 2023. He is a Vice President of the Buyout team and is based in New York.

Prior to joining Quilvest in 2023, Omar was a Senior Associate at Bregal Partners, where he focused on investments in Consumer and Business Services.

Prior to joining Quilvest, Omar was an Associate at Partners Group, where he focused on investments in Healthcare.

Omar started his career as an Investment Banking Analyst at Guggenheim Partners.

Holds a Bachelor of Science in Commerce, with a concentration in Finance from the University of Virginia.

Deals:

Tri-Imaging | Exer | Acuiti Labs

Jared joined Quilvest Capital Partners in 2010. He is a Managing Director of the Buyout team and is based in New York.

Prior to joining Quilvest in 2010, Jared worked as an Analyst at Lazard Middle Market

Jared holds a B.S. in International Studies with a Minor in Economics from Northwestern University and an M.B.A. from the University of Chicago Booth School of Business with concentrations in accounting and entrepreneurship.

Deals:

STP | Anthony’s | Metro | Luke’s | American Franchise Capital | Tri-Imaging | Fuller’s Food

Lawrence Neubauer

Investment Committee memberLarry joined Quilvest Capital Partners in 2006. He is an Investment Committee Member of the Buyout team and is based in New York.

Larry has more than 15 years of experience on Wall Street as an investor, attorney and banker. In his career on Wall Street, he has participated in over 30 buyouts transactions consisting of billions of dollars of capital.

Before joining Quilvest Capital Partners, he was at Centre Partners. Prior to joining Centre Partners, Larry was the founding member of Malakand Capital. Prior to that, Larry was at SG Capital Partners.

His other previous professional experience includes positions at White & Case, Bankers Trust Company (in the LBO and Energy Groups), the U.S. Department of Commerce and The White House.

Larry earned his A.B. from the Woodrow Wilson School of Public and International Affairs at Princeton University and his J.D., cum laude, and M.B.A. from the University of Chicago.

Deals:

STP | Command Alkon | Crown |Creative | Exer

Ben joined Quilvest Capital Partners in 2013. He is a Partner of the Buyout team and is based in New York.

Prior to joining Quilvest Capital Partners, Ben worked in M&A at the Global Consumer Products & Retail Group of UBS Investment Bank in New York.

Ben graduated with honors from Georgetown University where he studied Finance and Government.

Deals:

STP | Command Alkon | Crown | American Franchise Capital | Phaidon | Exer | Acuiti Labs

Buyout Portfolio

Acuiti Labs is a leading specialist SAP consulting firm that assists large, blue-chip businesses globally with the implementation of SAP Billing and Revenue Innovation Management (“BRIM”) software

- Investment Status: In Portfolio

- Investment Date: February 2024

- Sector: Outsourced Services

- CEO: Manoj Harbhajanka

- Location: UK and US

- Website: https://www.acuitilabs.com/

Ermitage is a K12 education group with three leading private international bilingual schools located in France and in Belgium, providing a bilingual curriculum to close to 2k students from the age of 3 to 18 years

- Investment Status: In Portfolio

- Investment Date: December 2023

- Sector: Education

- CEO: Jim Doherty

- Location: France and Belgium

- Website: https://www.ermitage.fr/

RCA is a French software editor dedicated to chartered accountants with two product lines: a BtoB advisory software suite and “MEG”, a full SaaS BtoBtoB collaborative platform.

- Investment Status: In Portfolio

- Investment Date: July 2023

- Sector: Software and Telecom

- CEO: Jérôme Clarysse

- Location: France

- Website: https://rca.fr/

Cabaïa is a leading omnichannel accessories brand, commercializing backpacks, beanies, upsell and other accessories (socks, flasks, etc.). Its products are distributed mostly through a mix of DtoC (website), owned stores and wholesale.

- Investment Status: In Portfolio

- Investment Date: June 2023

- Sector: Next-gen consumer

- CEO: Bastien Valensi

- Location: France

- Website: https://www.cabaia.com/

Fullers Foods is the leading end-to-end outsourced manager of private label programs for grocers in the UK. Its services include product sourcing, supplier management, quality assurance, new product development, packaging design and inventory and logistics management.

- Investment Status: In Portfolio

- Investment Date: November 2022

- Sector: Next-gen consumer

- CEO: Kevin Smith

- Location: United Kingdom

- Website: https://www.fullersfoods.com/

Les Secrets de Loly is a fast-growing natural hair care brand dedicated to textured hair (i.e., wavy, curly and frizzy). LSL commercializes a range of products with natural ingredients (shampoo, conditioner, hairstyling and leave-in care products).

- Investment Status: In Portfolio

- Investment Date: May 2022

- Sector: Next-gen consumer

- CEO: Kelly Massol

- Location: France

- Website: https://www.secretsdeloly.com/

UrgentMED is the premier independent network of urgent care clinics in Southern California and leading provider of comprehensive healthcare services through its footprint of urgent care clinics.

- Investment Status: In Portfolio

- Investment Date: November 2021

- Sector: Multi-Unit

- CEO: Rob Mahan

- Location: United States

- Website: https://exerurgentcare.com/

Solem is a state-of-the art designer and assembler of connected devices focused on telecare, irrigation and pool founded in 1984 and managed by Frédéric Comte since 2016.

- Investment Status: In Portfolio

- Investment Date: July 2021

- Sector: Software and Telecom

- CEO: Frédéric Comte

- Location: France

- Website: https://www.solem.fr/

Minafin is a leading global fine chemical developer and manufacturer, specialising in active pharmaceutical ingredients (“API”) manufacturing and green chemistry founded in 2004. The group operates six industrial facilities in France, Belgium, Germany and the United States supporting international customers in the life sciences and high-tech.

- Investment Status: In Portfolio

- Investment Date: July 2021

- Sector: Outsourced Services

- CEO: Frédéric Gauchet

- Location: Belgium and US

- Website: http://minafin.com/

Blue is a French B2B alternative telecom operator, founded in 2006. It offers subscription-based, turnkey telecommunication and IT services to SMEs. Services are rendered with top-notch infrastructures, including a fully-certified data center at Blue’s headquarters.

- Investment Status: In Portfolio

- Investment Date: July 2020

- Sector: Software and Telecom

- CEO: Nicolas Boittin

- Location: France

- Website: https://www.bt-blue.com/

Tri-Imaging Solutions is an integrated provider of parts and services to the diagnostic imaging equipment maintenance and repair market. The company provides repair parts, on-site servicing, technical training, and technical support to its customers.

- Investment Status: In Portfolio

- Investment Date: September 2019

- Sector: Outsourced Services

- CEO: Eric Wright

- Location: United States

- Website: https://triimaging.com/

Phaidon International (“Phaidon”) is a multi-brand global recruitment business focused on hard-to-find, business-critical roles within niche verticals. Phaidon operates five organically established brands, across 11 different offices in three core regions, EMEA, U.S. and APAC.

- Investment Status: Realized

- Investment Date: April 2018

- Exit Date: August 2022

- Sector: Outsourced Services

- CEO: Harry Youtan

- Location: Global

- Website: https://www.phaidoninternational.com/

Groupe EDH is a French network of higher education schools dedicated to communication, arts management, graphic design and journalism, operating 8 brands over 26 campuses.

- Investment Status: Realized

- Investment Date: November 2017

- Exit Date: July 2022

- Sector: Education

- CEO: Amin Khiari

- Location: France

- Website: https://www.groupe-edh.com/

Eudonet is a leading designer and provider of full-SaaS CRM solutions covering sales, marketing, communication and client services focused on a selected number of verticals including membership organizations, nonprofit organizations, education, public sector and real estate.

- Investment Status: Realized

- Investment Date: March 2017

- Exit Date: January 2022

- Sector: Software and Telecom

- CEO: Antoine Henry

- Location: France

- Website: https://fr.eudonet.com/

Creative Extruded Products is a leading supplier of highly engineered extruded molding products used in the North American automotive glass molding industry, both to the original equipment manufacturers and aftermarket segments.

The restaurant segment focuses on serving authentic Maine-inspired menu offerings anchored in sustainability across its U.S. based shacks and international locations (in Japan and Taiwan). The company’s seafood segment buys, produces and sells seafood products to its own restaurants, wholesalers, grocers and consumer packaged goods retailers.

- Investment Status: In Portfolio

- Investment Date: May 2016

- Sector: Multi-Unit

- CEO: Luke Holden

- Location: Global

- Website: https://www.lukeslobster.com/

Sogetrel is a leading engineering, building and services company specialized in design, construction and maintenance of telecommunication infrastructure, and digital communication.

- Investment Status: Realized

- Investment Date: February 2016

- Projected Exit Date: October 2018

- Sector: Software and Telecom

- CEO: Xavier Vignon

- Location: France

- Website: https://www.sogetrel.fr/

Crown Health Care Laundry Services is the leading provider of outsourced linen management to hospitals and other healthcare facilities (i.e., clinics, skilled nursing facilities, etc.) in the Southeast U.S.

- Investment Status: Realized

- Investment Date: March 2014

- Exit Date: March 2021

- Sector: Outsourced Services

- CEO: Don Haferkamp

- Location: United States

- Website: https://www.crownlaundry.com/

Metro Franchising is the fourth largest franchisee in the Dunkin’ system and the largest Dunkin franchisee in the New York City metro region and was founded in 1998. Dunkin franchisees operate in the quick service restaurant segment providing coffee, donuts, baked goods and other snacks.

- Investment Status: In Portfolio

- Investment Date: December 2013

- Sector: Multi-Unit

- CEO: Stuart Cohen

- Location: United States

Command Alkon is the leading global provider of integrated supply chain software and technology solutions for the heavy building materials industry, namely concrete, cement, aggregate and asphalt industries.

- Investment Status: Realized

- Investment Date: June 2013

- Exit Date: April 2020

- Sector: Software and Telecom

- CEO: Phil Ramsey

- Location: United States

- Website: https://www.commandalkon.com/

Acrotec is a Swiss-based group specialized in the manufacturing of high precision parts mainly for Swiss mechanical watches and for industrial applications.

- Investment Status: Realized

- Investment Date: June 2012

- Exit Date: June 2016

- Sector: Niche manufacturing

- CEO: François Billing

- Location: Switzerland

- Website: https://www.acrotec.ch/

Anthony’s Coal Fired Pizza is a leading, high growth restaurant concept in the emerging “small box dining segment” with a focused menu including coal-fired pizzas and “Italian soul food” creations.

- Investment Status: Realized

- Investment Date: December 2011

- Exit Date: December 2015

- Sector: Multi-Unit

- CEO: Anthony Bruno

- Location: United States

- Website: https://acfp.com/

ST Products ( “STP”) is a niche manufacturer of redrawn, small diameter copper, aluminium, and specialty alloy tubes that are critical components for several industrial and consumer applications, including heavy equipment, appliance, electrical, heat transfer, and welding.

- Investment Status: Realized

- Investment Date: June 2011

- Exit Date: November 2018

- Sector: Niche manufacturing

- CEO: Steve Drew

- Location: United States

- Website: http://www.smalltubeproducts.com/

Tiendas 3B is the first chain of hard-discount grocery stores in Mexico, modeled on the typical European hard-discounters’ operations: limited product selection (allowing for more volume discounts from suppliers, and lower logistics costs), small stores with low rents and limited staff. Tiendas 3B operates its own distribution centers and is geographically focused on Mexico City and its suburbs.

- Investment Status: In Portfolio

- Investment Date: May 2004

- Sector: Multi-Unit

- CEO: Anthony Hatoum

- Location: Mexico

- Website: https://tiendas3b.com/